Financial Forecasting for Business Growth

Financial forecasting is a crucial aspect of any business, especially in the tech industry where rapid growth and innovation are common. By accurately predicting future financial performance, a company can make informed decisions that drive growth and success. In this article, we will explore the importance of financial forecasting for tech businesses and provide tips on how to create a solid financial forecast.

The Importance of Financial Forecasting

Financial forecasting allows tech companies to plan for the future, identify potential challenges, and take advantage of opportunities for growth. By analyzing past financial data and making educated predictions about future performance, businesses can make strategic decisions that align with their long-term goals.

Financial forecasting also helps tech companies secure funding from investors or lenders. A strong financial forecast demonstrates a company’s ability to manage its finances effectively and grow its bottom line, making it more attractive to potential investors and creditors.

Creating a Solid Financial Forecast

When creating a financial forecast for your tech business, it’s important to consider both internal and external factors that could impact your company’s financial performance. Here are some tips for creating a solid financial forecast:

1. Gather and Analyze Data

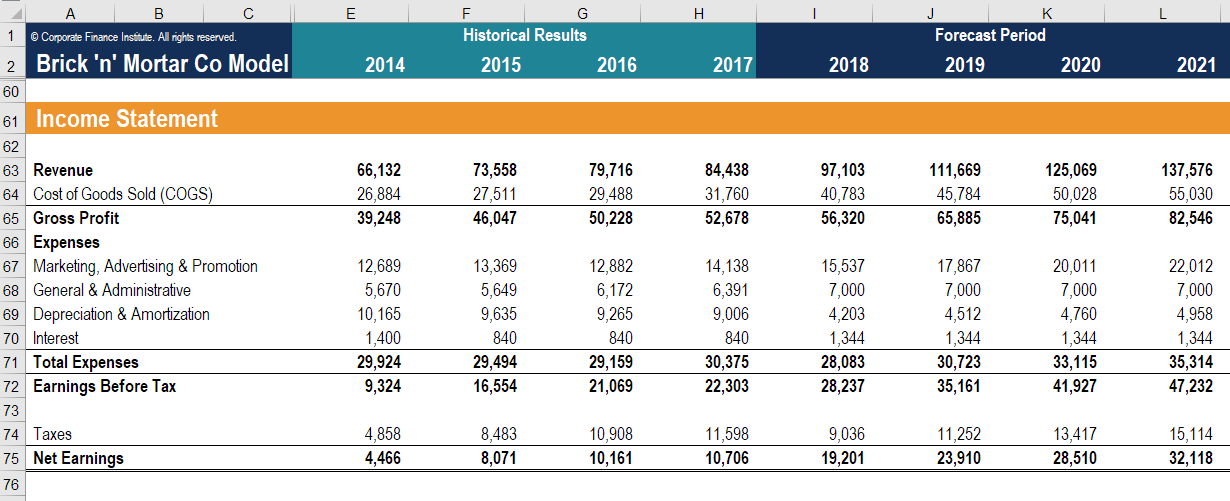

Start by gathering and analyzing past financial data, such as income statements, balance sheets, and cash flow statements. Use this information to identify trends and patterns that can help you predict future performance.

2. Identify Key Assumptions

Identify the key assumptions that will drive your financial forecast, such as sales projections, operating expenses, and pricing strategies. Make sure your assumptions are realistic and based on market research and industry trends.

3. Use Multiple Scenarios

When creating your financial forecast, consider creating multiple scenarios based on different assumptions and outcomes. This will help you prepare for unexpected events and make more informed decisions about your business strategy.

4. Monitor and Adjust

Once you have created your financial forecast, it’s important to regularly monitor your actual financial performance against your projections. If you notice any discrepancies, adjust your forecast accordingly to stay on track towards your business goals.

Conclusion

Financial forecasting is a critical tool for tech companies looking to achieve growth and success. By accurately predicting future financial performance and making informed decisions based on those predictions, businesses can position themselves for long-term success in a competitive market. By following these tips and best practices for creating a solid financial forecast, tech companies can confidently navigate the challenges and opportunities that lie ahead.